Uncertainty Builds as Prices Rise

Inflation has become a key concern again in 2025, especially as new U.S tariffs take effect. While prices for groceries and gas have calmed slightly since 2023’s inflation peak, new trade policies may reverse that trend. Economists warn that inflation could once again spike due to new political choices rather than a global pandemic.

Experts say these tariffs are likely to impact not just prices but also decisions made by businesses and the federal reserve

“Tariffs are highly likely to generate at least a temporary rise in inflation.”

This statement from Quartz shows concern shared by economists and investors. When foreign goods become more expensive due to tariffs companies pass those costs onto customers. That’s how inflation spreads so quickly.

“The level of the tariff increases announced so far is significantly larger than anticipated.”said Jerome Powell, from the Federal Reserve Chair.

Tariffs have increased the risk larger than expected. Retailers might raise prices on basic items such as clothing and electronics, while manufacturers may stop the making process due to the rising cost of goods.

Trade experts from Brooking Institution agree that trade barriers like tariffs add cost for businesses and consumers.

“Trade barriers such as tariffs tend to increase costs for manufacturers and consumers, which can feed into broader inflationary pressures,” said by Powell, reported by Brookings Institution

Local Impact in Oregon

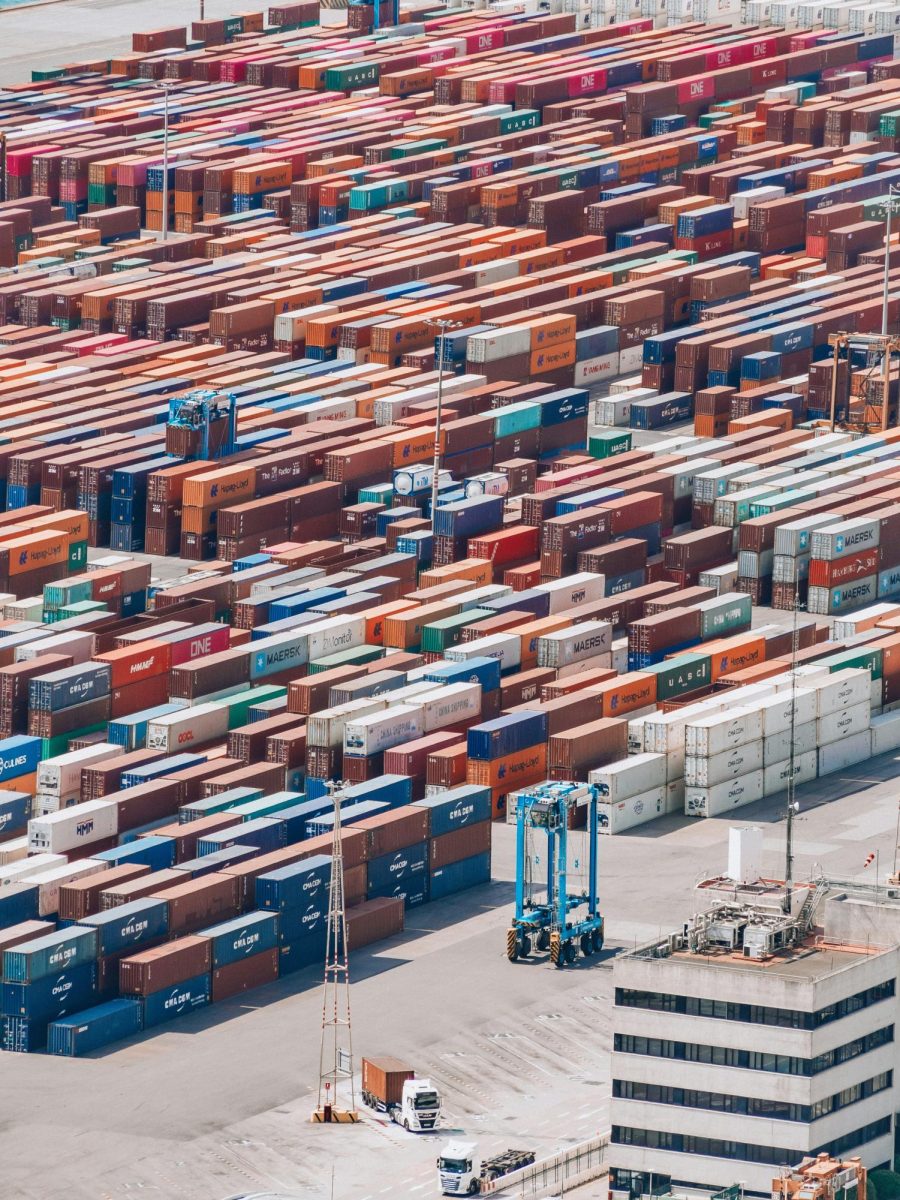

Oregon is not immune to the effects of these worldwide tariff changes. With ports in Portland that play a big role in international trade many local businesses depend on imported goods to run their businesses. The rising tariffs could cause a direct price spike for customers.

“Tariffs are highly likely to generate at least a temporary rise in inflation,” said Fed Chair Jerome Powell, Quartz reported. The cost of electronics, clothing and construction materials will rise.

The Brookings Institution also noted, “Trade barriers such as tariffs tend to increase costs for manufacturers and consumers,” Oregon’s manufacturing sectors may slow production or even increase prices. This will have an impact on workers and business growth.

According to Powell in the ABA Banking Journal, “The same is likely to be true of the economic effects, which will include higher inflation and slower growth.”

This suggests that Oregon could possibly face the risk of rising prices and lowered job opportunities also known as stagflation.

Inflation psychology may make things worse. The Federal Reserve Bank of St. Louis stated: “Tariffs also shift inflation expectations, which can make prices rise more entrenched.” If Oregon consumers rush to buy goods before prices climb it may trigger a shortage and panic almost exactly like what happened in 2020 before Covid.

Growth Slows as Prices Climb

The consequences of tariffs don’t stop at inflation. Many experts also predict that economic growth will also slow.

“The same is likely to be true of the economic effects, which will include higher inflation and slower growth,” said Fed Chair Jerome Powell in a recent article from ABA BANKING.

In other words while inflation rises due to tariffs businesses may have to make cut backs. This combination of slower growth and rising prices is known as “stagflation”. Stagflation is a problem because it’s hard to fix both rising prices and a slowing economy at the same time.

Michael Barr points out that the fragile supply chain could add to the inflation risk and could cause it to rise higher in a recent article from The Street.

“Higher tariffs could lead to disruption to global supply chains and create persistent upward pressure on inflation.”

How Expectations Can Shape Reality

The Federal Reserve Bank of St. Louis has found that psychology can affect events before they even happen.

“Tariffs also shift inflation expectations, which can make price rises more entrenched,” said Joseph Brusuelas, Chief Economist at RSM US.

When people believe prices will go up they may rush to buy goods, creating shortages and driving prices higher. Businesses will prepare for this by raising prices in anticipation.

According to Federal Reserve Governor Adriana Kugler “When businesses and consumers expect prices to keep rising, wage demands and price setting behavior can accelerate inflation.”

Workers may ask for higher wages to keep up which leads companies to increase prices again to pay for those wages. It becomes a cycle that’s why the Federal Reserve is trying hard to keep inflation expectations low before they get out of hand again.

Federal Reserve Chairman Jerome Powell emphasized,“The Federal Reserve must be vigilant in monitoring these expectations to maintain price stability.”

The Economic Policy Institute also adds that rising tariffs affect workers directly due to companies having to lay off workers to be able to afford new prices.

“Rising tariffs can lead to increased production costs that are often passed to workers in the form of job losses or suppressed wages, complicating inflation dynamics.”

Financial firms are speaking. Goldman Sachs a leading investment bank has spoke on how the tariffs might affect prices.

“The inflation rate is just 0.1 percentage points higher than April’s rate of 2.3%,” said Justin Boggs in a recent article by Wcpo.

If the inflation rate rises over 4% that would put it above the Federal Reserve’s 2% target which may cause them to raise interest rates again. That would affect car loads, credit card debt and much more.

“Goldman Sachs has spotlighted alternative safe-haven assets, such as gold and oil, amid rising tariffs and economic uncertainty.”

When Investors are uncertain of the market they turn to goods like gold or oil. Their prices have already started to climb in anticipation of inflation. Harvard Business Review says that businesses are adjusting pricing and supply chains in response to tariffs.

“Companies facing higher input costs from tariffs may adjust pricing strategies that contribute to inflation, while also re-evaluating supply chain resilience,” said by Rahi Mohammad.

The Global Impact of U.S Policy

The United States isn’t the only country feeling the effects of the new tariffs. International groups like the OECD have raised concerns about global inflation risks.

“ We now expect U.S. inflation to rise to 2.8% in 2025, up from the 2.5% last year, with trade tensions playing a role,” said economists from Morgan Stanley Research, as quoted by CBS News.

This 0.3% change seems small but it points to a bigger trend. Many countries shape their models based on U.S. trade.

“Supply chain disruptions combined with tariffs pose significant risks to price stability worldwide,” said Isabel Schnabel, a member of the Executive Board of the European Central

Tariffs can cause delays and shortages especially with things like electronics or auto parts because we get them from places like China. Tariffs will make prices go up worldwide and not just in the U.S.

The World Trade Organization also warns about trade restrictions.

“Trade restrictions like tariffs can disrupt global trade flows and raise prices for consumers worldwide, pushing inflation upward.”

“U.S.-China trade tensions also present a more favorable scenario for the global economy. Stronger growth in the U.S. and China will likely have positive spillover effects on the rest of the world,” reported by JPMorgan.

But this positive outlook depends on trades staying stable. IF tensions between the U.S and China get worse it could slow down growth and cause more problems.

A Balancing Act

While the new tariff might seem like an efficient way to protect jobs and American industries, they can come with some serious consequences and immediate downsides. These include higher prices for goods like groceries, gas and more. It will also cause slower economic growth and an unstable market.

Experts from the Federal Reserve, top international economists and major banks agree if trade tensions keep rising, inflation might stay above the normal levels even through the rest of the 2025 year. The biggest challenge we face now is how we can help figure out how to support American workers.