(This story was originally published as Portland’s Housing Supply Problem: Will the Shortage have a Solution? in The Elevator in June, 2022.)

Portland, Oregon is a beautiful metropolitan area surrounded by lush forests, snowy mountains, and wide rivers. For outdoor enthusiasts, the city is only a short drive from activities such as skiing, biking, and river rafting, as well as only an hour and a half from the beach.

With all this natural beauty, it’s no surprise that the city is such an attractive place to live. In the last 20 years, Oregon’s population has increased by 22.2% (beating the national average by around 5%), and the city of Portland itself has grown even faster.

However, along with this rapid population increase comes an increasing need for housing in and near the city, so that people can commute into the city to work. As this demand increases, consumers and policymakers alike have found themselves running into a major problem: restrictive urban growth boundaries that have caused Portland homes to skyrocket in value.

Dr. Gerard Mildner, a professor at PSU and expert in real estate finance, says that Portland’s urban growth restrictions were developed as a response to other states’ urban sprawl. “A lot of our land use laws were written in the 1970s…and the intent was to avoid the planning outcomes that happened in California,” Dr. Mildner explains. “And so, we’ve had within the Portland Metro Area, on the Oregon side at least, a growth boundary. In other countries, you might call it a green belt, but basically the idea was to prevent urban area from expanding into the agricultural areas.”

In theory, this “green belt” provides an environmental buffer between urban and rural areas by preventing large, sprawling suburbs that provide housing for upper-middle class families at the expense of the forest and agricultural industries.

However, these well-intentioned land use policies have had unintended consequences: as the population increases, it reduces the amount of land per person in urban areas. According to Mildner, “since the boundary’s been established, our metropolitan population has expanded by 80%, but our UGB–our urban growth boundary–has only expanded by 15%. And this is a chronic problem.”

Urban Expansion vs. Agricultural Preservation

In the 1970s, as Portland’s population was beginning to grow more quickly, city planners were facing a dilemma: Portland’s urban growth was beginning to expand out from city boundaries and into surrounding communities, prompting developers to take interest in land further from city center.

California, and other states before it, had allowed this development to take place without much regulation, blending urban and rural through dozens of miles of sprawling suburbs that surrounded their largest cities.

Instead of allowing this same kind of unchecked expansion in Oregon, Metro officials turned to northern European countries like the UK as an example of a more “sustainable” approach to urban growth. The result? Portland’s unique “green belt.”

“We have many, many parcels that are exclusively for farm use, or exclusively for forest use.” Mildner asserts. “Once you go beyond the boundary, you can’t really develop housing, insofar as it’s kind of ‘one house per farm’ or, you know, ‘one house per forested lot’.” What’s more, Mildner says, in the Willamette Valley, these parcels of land can’t be split up any smaller than 50 acres. If that same amount of land was inside Portland’s UGB, it could theoretically fit 400 houses.

Furthermore, Mildner argues, the state’s requirements for Metro to provide enough land for housing are vague. Metro is required to zone enough land for a 20 year supply of housing. “The problem is is that that’s a really undefined concept,” says Mildner, “because if you develop a density of, let’s say, Brooklyn, New York, or Philadelphia, you could pack a lot of people into an acre of housing. On the other hand, if you build them at lower densities, like might be more typical of a place like Oregon City, you might need a lot more land. The decision of whether to expand the boundary is somewhat subjective, even though its got this official ‘20 year land supply’ in the regulation.”

These policies mean that, while there is an abundance of land surrounding Portland, there is a shortage of housing.

According to Mildner, this isn’t necessarily unique to Portland. “The reason why San Francisco and Los Angeles have higher housing prices is because their land costs are higher. You’re trying to squeeze more and more people into a given metro area.”

For cities like San Francisco that don’t have enough land to continue expanding their metro area to keep up with population growth, this price increase is unavoidable. For Portland, its the price residents pay to keep their community green.

Zoning and Infrastructure Changes Could Make Building New Housing Easier

While expanding the urban growth boundary is one possible solution to the housing supply problem, there are other policies Metro could–or already did–attempt to rework to better fit current population needs.

One of these potential areas for change are zoning laws. According to Cornell’s law dictionary, a zoning law is “a municipal law that outlines permitted uses for various sections of land.” When talking about residential housing, zoning laws can outline how tall buildings can be, and even how many families can live in them.

Dr. Mildner recognizes that Metro is already working to adjust its zoning laws. “We’ve done some good things, at the state level, to reform single-family zoning,” he remarks. “Cities all across the region are now adjusting their zoning policies to allow for accessory dwelling units and duplexes in a lot of neighborhoods that have previously been single-family homes.”

However, Mildner warns that these changes won’t be as effective as planners hope. He notices that Oregon housing production, which slowed during the 2008 recession, has still not returned to the same level it was at in the 1990s.

One cause of this ineffectiveness, according to Mildner, are laws known as inclusionary zoning laws—laws that attempt to account for the difficulties faced by low-income families in paying a monthly rent. These laws make developers and investors more hesitant to commit to building new housing, as they often take losses from stipulations such as mandated rent reductions.

Another policy that might lower housing prices is the construction of more roads. When access to rural areas is facilitated by an increase in roadways, it incentivizes developers to construct housing along those roads, and allows them to do so more quickly and easily.

Unfortunately, increasing road construction is often controversial. More roads often means less land for forest and agriculture, not to mention an increase in cars on the road, all of which often concerns environmentalists.

Mildner, however, believes these concerns are less pressing than Portland’s housing shortage. “Compounding that issue is global warming, but we also have the potential for cars which are much less polluting, if not electric, so to me, that whole issue is a red herring. We should be building more roads to facilitate housing construction.”

Pandemic Solutions: Short-Term Success

Portland’s officials recognize that rising prices have contributed to financial insecurity and rising rates of homelessness. According to Jordan Mulvihill, a graduate student in the Master of Real Estate Department and a fellow with the Oregon Association of Realtors at PSU, “In October 2015, Portland City Council declared a state of emergency to help address the city’s growing homeless and housing affordability crisis.”

These issues have only gotten worse since 2015, as the world has had to grapple with the lasting effects of the COVID-19 pandemic.

Oregon’s legislature has come up with a number of solutions, the first of which was the distribution of the 204 million dollars granted in Federal Emergency Rental Assistance under the 2020 CARES Act.

Dan March, a Multi-Family Northwest student fellow, writes, “In December 2020, Oregon passed House Bill 4401 which arranged $150 million to be distributed by Oregon Housing and Community Services (“OHCS”) through the Landlord Compensation Fund (“LCF”).” This original distribution was followed by subsequent extensions and distributions, eventually leading to a “new phase of rental assistance funding” that will foreseeably continue to use federal rent assistance to subsidize rents until 2025.

Federal money, however, is not the only source of relief for renters. Oregon’s state legislature has also began developing housing projects to provide low cost apartments for those most in danger of being unable to afford Portland’s high cost of living.

One of these, Project Turnkey, “uses grant money to acquire hotels and motels to use as emergency housing during the pandemic, with intentions to convert them into a permanent supply of transitional, supportive, and affordable housing units…Project Turnkey was able to acquire and convert 865 new housing units in Oregon, at the average cost of $87,700 per unit. That’s over 60% less the average cost of a new affordable housing unit,” Mulvihill says.

According to Nate Grein, another graduate student in the MRED, two other programs, the Portland Housing Bond and Metro Housing Bond, are, “partly responsible for Portland seeing one of the largest per-capita investments in affordable housing in the entire US.”

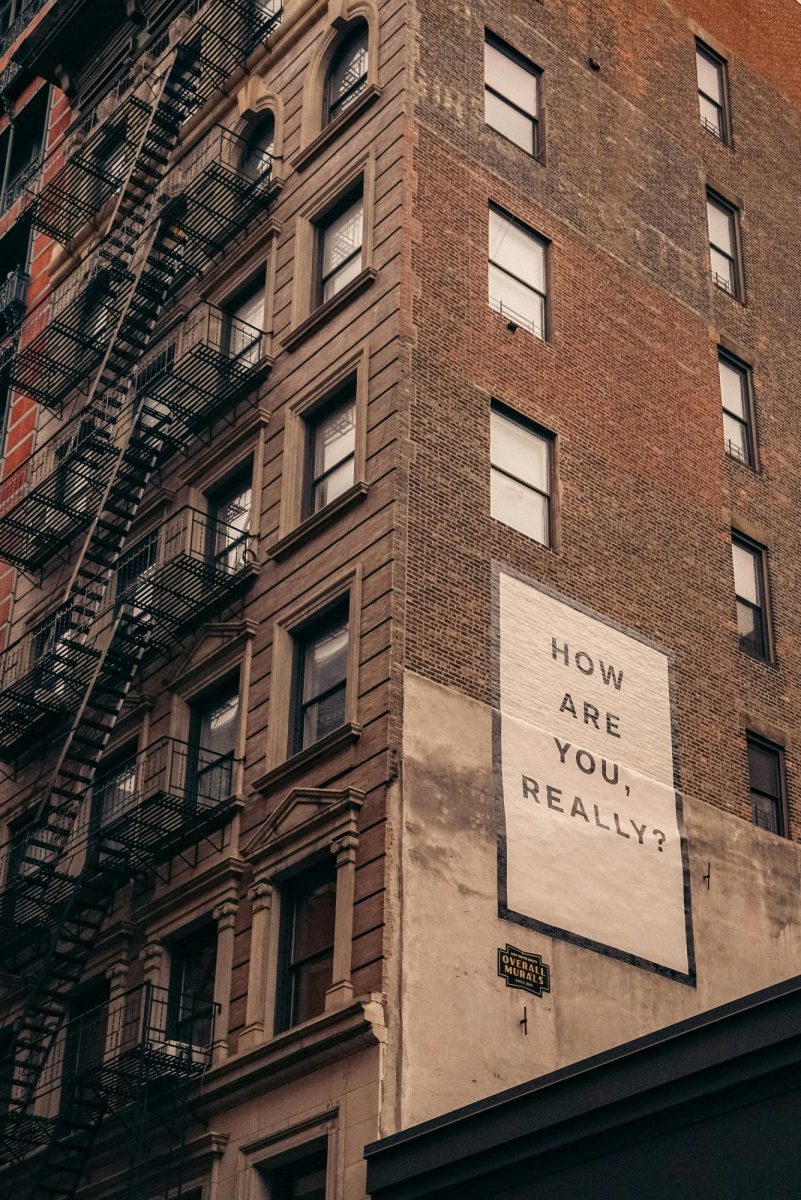

Gen Z: Grew Up in Portland, but Can’t Afford to Live Here

As Portland families grow older, many young people are looking to rent their first apartment or other living space. Unfortunately, homeownership and renting in Portland have changed since their parents bought homes 20 years ago. Despite recent political efforts to increase renter’s assistance, the government can only afford subsidize the market for the short-term.

According to rentdata.org, the rent for a studio apartment in the Clackamas County Metro is almost $500 above Oregon’s ‘fair market rent,’ a number determined by the Department of Housing and Urban Development to determine the scope of government aid for federally assisted housing. And as the rental you’re looking at gains extra bedrooms, or amenities, the gap only widens.

These high rents aren’t realistic for someone working on or near minimum wage. First time renters who are looking to live near where they work in Portland might be in for a shock, especially as rising interest rates, ushered in by federal increases this spring, are already affecting the market. The reality is that Portland may be turning into a city whose rental rates can’t accommodate those with less established careers, or those who are in a less stable financial situation.

This problem originated, Jordan Mulvihill writes, when single-room occupancies, or SROs, began to be converted from rentable residential dwellings into, “offices, luxury condos, or tourists’ hotels.”

“Housing nonprofit Northwest Pilot Project found that from 1978 to 2015, Downtown lost nearly 40% of its rentals (about 2,000 units) that were affordable to minimum wage earners. Many of these units were SROs,” Mulvihill said.

This incredible reduction in the amount of viable housing for low-earners, like young adults just out of high school or college, in Portland has meant that new renters might have to start looking elsewhere to rent their first apartment or buy their first homes.

“If we stay with the policies we’re on, I think the outcome that’s most likely for Portland is what I sometimes call the Santa Barbara solution,” Mildner said. “If you’re a young person growing up in Santa Barbara, and you don’t have, you know, a rich daddy, and you don’t have a great job, you’re not gonna live in Santa Barbara. You’re gonna move to the places where job opportunities are more plentiful, and housing is more affordable.”

For Gen Z, this could mean moving to a surrounding community like Beaverton, Tualatin, Gresham, or Oregon City. It could also mean moving away from Portland entirely, and relocating to Salem, Eugene or even out of state entirely. As Portland’s housing market becomes more competitive, Portlanders may have to ask themselves: is living here really worth the cost?